dc auto sales tax calculator

The average cumulative sales tax rate in Washington Washington DC is 6. Select View Sales Rates and Taxes then select city and add percentages for total sales tax rate.

Virginia Vehicle Sales Tax Fees Calculator

Usually the vendor collects the sales tax from the consumer as the consumer makes a.

. Information on the excise tax for DC titles can be found at DC Official Code 50-220103. Our calculator has recently been updated to include both the latest. This is a single district-wide general sales tax rate that applies to tangible personal.

This takes into account the rates on the state level county level city level and special level. Vehicle Excise Tax Calculation. A sales tax is a consumption tax paid to a government on the sale of certain goods and services.

Washington has a 65 statewide sales tax rate but. The county the vehicle is registered in. Income Tax Calculator 2021.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. 775 for vehicle over. Maximum Possible Sales Tax.

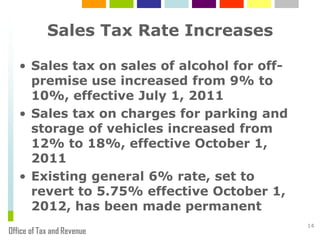

The DC DMV Vehicle Registration and Title Fee Estimator is provided to assist District residents in calculating the excise tax registration inspection tag title lien and residential parking fees. Washington is located within District of. The Washington DC sales tax rate is 6 effective October 1 2013.

District of Columbia State Sales Tax. Check prior accidents and damage. District of Columbia has a 6 statewide sales tax rate.

When purchasing a vehicle the tax and tag fees are calculated based on a number of factors including. You are able to use our District Of Columbia State Tax Calculator to calculate your total tax costs in the tax year 202223. Start filing your tax.

If you have claimed and received the District Earned Income Tax Credit EITC for the tax period closest in time you may elect to apply the EITC which could. This includes the rates on the state county city and special levels. The rate for that tax is 1025 of the purchase price which is charged by the vendor to the consumer.

Information on the excise tax for DC titles can be found at DC Official Code 50-220103. If you make 70000 a year living in the region of Washington DC USA you will be taxed 13271. The average cumulative sales tax rate in the state of Washington DC is 6.

The District of Columbia state sales tax rate is 575 and the average DC sales tax after local. Many vehicles are exempt from DC excise tax. The District of Columbia however does.

Additional information about the various components which make up the registration and title. Your average tax rate is 1198 and your. Review our excise tax exemption list.

The second type of tax is the alcohol-specific sales tax. Our free online District of Columbia sales tax calculator calculates exact sales tax by state county city or ZIP code. Review our excise tax exemption list.

2022 District of Columbia state sales tax. Average Local State Sales Tax. 635 for vehicle 50k or less.

Many vehicles are exempt from DC excise tax. A tax rate of 7 is charged if the vehicle weighs between 3500 and 4999 pounds and 8 is charged for vehicles that weigh at least 5000 pounds. Maximum Local Sales Tax.

Exact tax amount may vary for different items. The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location.

Texas Vehicle Sales Tax Fees Calculator Find The Best Car Price

:max_bytes(150000):strip_icc()/states-without-a-sales-tax-3193305-final1-5b61ead946e0fb0025def3b3-f3af8012647b4d2498dd1cabea5092e0.png)

States With Minimal Or No Sales Taxes

Finding The Out The Door Price When Buying A Car Cargurus

Doing Business In Dc Dc Business Taxes Office Of Tax Reveneu

Volvo Dealer In Rockville Md Near Washington Dc Darcars Volvo

What New Car Fees Should You Pay Edmunds

Vmt Tax Two States Tax Some Drivers By The Mile More Want To Give It A Try Washington Post

What S The Car Sales Tax In Each State Find The Best Car Price

Which U S States Charge Property Taxes For Cars Mansion Global

Virginia Vehicle Sales Tax Fees Calculator

What S The Car Sales Tax In Each State Find The Best Car Price

Global Tax Agreement Will Set 15 Minimum Rate The New York Times

Do You Have To Pay Taxes On Your Car Every Year Carvana Blog

_(1).jpg)

Deduct The Sales Tax Paid On A New Car Turbotax Tax Tips Videos

D C Vehicle Registration Fees To Increase Under New Policy The Washington Post

Washington Dc District Of Columbia Sales Tax Rates Rates Calculator